The sale of tools and molds plays a major role in the automotive manufacturing industry and also in all sectors involved in the manufacture of semi-finished products.

Molds are often sold by the manufacturer, who transfers ownership of the mold to a customer based in the European Union. However, the mold remains on the manufacturer’s premises and is used to produce parts that are also sold by the manufacturer.

In principle, the sale of a mold that remains on the manufacturer’s premises should be treated as a local supply, since ownership is transferred on the manufacturer’s premises without any intra-Community transport. However, each country has its own interpretation of VAT rules and its own instructions, particularly when the sale of the tool or mold that remains in the territory of the manufacturer’s Member State enables the production of parts that are subject to intra-Community deliveries by the latter.

In fact, some Member States refuse to allow the purchaser to deduct VAT on the purchase of the mold from the manufacturer on the grounds that the sale of the mold constitutes an intra-Community supply in the same way as the parts sold.

The CJEU attempted to clarify the situation in its October 23, 2025 ruling in Brose Prievidez (C-234/24).

Facts of the case

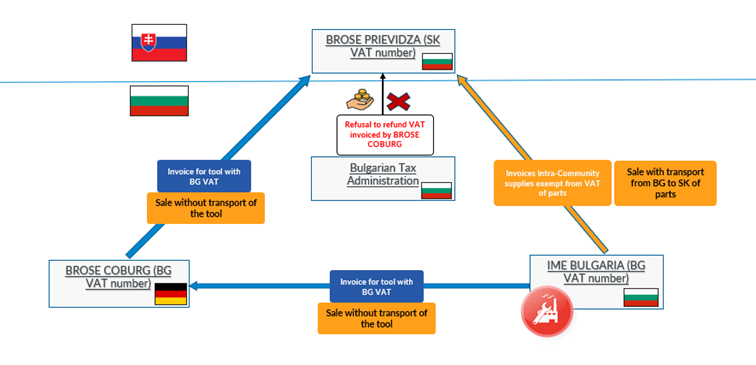

BROSE COBURG, based in Germany, purchased a special tool from a Bulgarian supplier, IME BULGARIA. This tool was intended to produce parts for BROSE COBURG’s sister company, BROSE PRIEVIDZA.

The tool remained on the premises of the manufacturer, IME BULGARIA, which used it to manufacture the parts, but ownership was transferred from IME BULGARIA to BROSE COBURG.

IME BULGARIA used the tool exclusively for the production of parts for BROSE PRIEVIDZA.

BROSE COBURG then resold the tool to BROSE COBURG, applying Bulgarian VAT on the sale on the grounds that the tool had not left the premises of the manufacturer IME BULGARIA.

BROSE PRIEVIDZA requested a refund of the Bulgarian VAT paid on the purchase of the tool. The Bulgarian tax authorities refused this request on the grounds that the delivery should be considered as an ancillary delivery to the VAT-exempt intra-Community deliveries of components from Bulgaria to Slovakia.

| Sale of the tool | Sale of parts manufactured from the mold | |

|---|---|---|

| Cash flow | IME BULGARIA > BROSE COBURG > BROSE PRIEVIDZA | IME BULGARIA > BROSE PRIEVIDZA |

| Transport | Bulgaria > Bulgaria | Bulgaria > Slovakia |

| VAT treatment | Sales with VAT (BG VAT rate) | Intra-Community deliveries exempt from VAT |

| Issues | Challenge to the deductibility of VAT by the Bulgarian tax authorities on PRIEVIDZA's purchase of the tool on the grounds that it constitutes ancillary supplies to intra-Community supplies exempt from VAT (parts) and that the sale of the tool should be subject to the same VAT treatment. | N/A |

Court judgment

The Court began by pointing out that an intra-Community supply can only benefit from VAT exemption if the goods actually leave the territory of the Member State of departure and are supplied to another Member State of the European Union.

In this particular case, the goods did not leave Bulgaria, so the intra-Community transaction should not, in principle, be accepted.

The Court then specified that each delivery must, in principle, be analyzed separately. Only in clear-cut cases, for example where the services are closely linked, do they objectively form a single, indivisible service, the separation of which would be artificial (the CJEU refers in this regard to the judgment of October 27, 2005, “Levob Verzekeringen and OV Bank,” C-41/04).

The Bulgarian administration had attempted to rely on the Part Service judgment (C-425/06), arguing that the transfer of the tools constituted an artificial fraction of the intra-Community supply exempt from VAT. The Court rejected this analysis: unlike in the Part Service judgment, no abuse or artificial arrangement was demonstrated in this case. The separation between the supply of the tool and the supply of the parts was based on genuine economic reasons, with separate contracts.

The economic operator selling the tool is BROSE COBURG, while the company selling the parts is IME BULGARIA.

The Court ruled that even though the two transactions are technically linked, they each retain their own economic logic and in no way constitute a scheme designed to commit tax fraud or obtain an undue tax advantage.

For BROSE PRIEVIDZA, ownership of the tool had concrete advantages: it allowed it to better control the industrial process, to limit its dependence on the supplier, particularly in the event of the latter’s bankruptcy, and to have the possibility of using or transferring the tool at a later date. These factors show that the sale of the equipment pursued an autonomous economic purpose, independent of the supply of parts.

The Court therefore held that Article 4(b) of Council Directive 2008/9/EC of February 12, 2008, must be interpreted as precluding the refusal to refund value added tax charged on the supply of equipment to a taxable person established in a Member State other than the Member State of purchase of that goods, where that equipment has not physically left the territory of the Member State of its supplier, unless, in view of all the circumstances characterizing the transactions in question, that supply must be regarded as forming part of a single, inseparable economic service or as being ancillary to a principal service consisting of intra-Community supplies of goods produced by means of that equipment and intended for that taxable person.

In the specific case, the Court did not consider, in view of the circumstances of the case, that the supply of the tool should be regarded as forming part of a single, indivisible economic service or as ancillary to a principal service consisting of intra-Community supplies of goods.

The delivery of the tool was therefore to be treated as a separate delivery subject to VAT; and the VAT applied to the sale of the tool by BROSE COBURG to BROSE PRIEVIDZA was therefore to be deductible.

Conclusion

The circumstances of the case made it easier for the Court to reach a decision, particularly given that there was an intermediary in the sale of the tool, namely BROSE COBURG.

The situation might have been different if the manufacturer, IME BULGARIA, had been the seller of both the tool and the parts directly to BROSE PRIEVIDZA.

We can therefore conclude that, even though an essential aspect of the VAT treatment applicable to the sale of tools and molds has been clarified, further clarification is still needed in certain specific circumstances, particularly when the sale of the tool and the parts are made to the same purchaser and are covered by a single contract.

This ruling highlights two important points:

- incorrectly invoiced VAT does not give rise to a right to deduct VAT. If the supplier refuses to issue a credit note and refund the incorrectly invoiced VAT, this may result in a net loss for the purchaser;

- it is important to consult VAT experts to analyze your transactions, both downstream and upstream, and that a case-by-case analysis based on the specific circumstances and national regulations should be preferred.

MaVAT can assist you with these analyses related to complex intra-Community issues.