The 2025 Finance Act repealed the ad hoc tax representation regime provided for in Article 289 A III of the French General Tax Code, which had been widely used by non-European companies to sell in the EU without direct VAT registration.

This mechanism is similar to “global tax representation” in Belgium, “limited tax representation” in the Netherlands, “rappresentante leggero” in Italy, etc. Not all Member States apply this regime, and its application may differ depending on the EU country.

Customs brokers authorized to act as occasional tax representatives in France will no longer be able to use their own VAT number as an occasional tax representative (VAT number beginning with “FR” followed by 2 letters and 9 digits, e.g., “FRXX123456789 “) to declare subsequent intra-Community deliveries under customs procedure 42 carried out in France.

This requires non-European companies not established in a country that has signed a tax debt recovery assistance agreement with France1 to register for VAT through a tax representative who will file VAT returns on their behalf (note that the tax representative is jointly and severally liable for the VAT relating to the obligations of the person they represent, so guarantees may be required).

Companies not established in the European Union that have been using the one-off tax representation regime to date have until December 31, 2025 (following the tax ruling of May 14, 2025 establishing a one-year postponement) to obtain an individual VAT number via a tax representative.

Reminder regarding imports under customs procedure 42

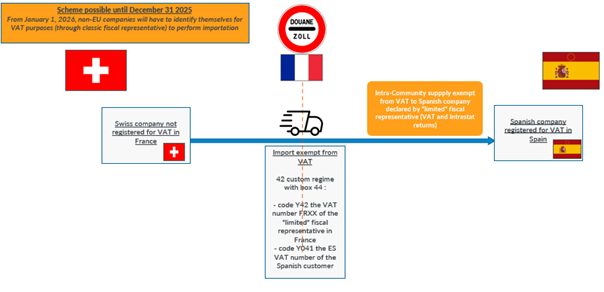

A Swiss company sells goods to a Spanish company and arranges for delivery directly to the end customer in Spain. The Swiss company bears the risk of accidental loss during transport (DDP Incoterm for the sale).

The goods are cleared through customs on French territory and, in view of the Incoterms used, the Swiss company acts as the importer of the goods.

| Companies established outside the EU and in a non-cooperative country2 with a VAT number in FR | Companies established outside the EU but in a cooperative country with a VAT number in FR | Companies established in the EU already identified for VAT purposes in FR | Companies established in the EU not identified for VAT purposes in FR |

|---|---|---|---|

| VAT identification via a mandatory tax representative | VAT identification via a tax representative | Use of the EU company's FR VAT number for imports under customs procedure 42 | Use of the one-time tax representative mechanism (VAT registration not required for these transactions only) |

Customs procedure 42 allows for VAT exemption on goods imported into France if the imported goods are immediately (within a reasonable period of a few days) shipped to another EU Member State and the importing company can provide proof of this immediate intra-Community shipment following importation.

Companies not established in the EU (Switzerland, for example) may appoint a one-off tax representative to appear with their own FRXX VAT number on the customs import declaration under customs procedure 42 filed in France.

The customs import declaration shows in box 44:

- The code FR03 followed by the FRXX VAT number of the ad hoc tax representative;

- The code FR3 followed by the ES VAT number of the Spanish customer.

Please note that these codes have been replaced by FR1 and FR2 since the Delta I/E customs reform.

As of January 1, 2026, non-EU companies will have to register via a tax representative responsible to the French tax authorities and obtain their French VAT number in order to carry out this type of transaction.

Companies established in the EU and companies already registered for VAT in France will be able to continue using customs regime 42.

The one-off tax representative regime has not been abolished. In this regard, the French authorities have provided information on the various alternative measures in force following these changes:

Conclusion

However, the 2025 Finance Act provides for the repeal of this one-off tax representation mechanism as of January 1, 2026.

In this context, regime 42 loses all interest for non-European companies since:

they must now be registered for VAT in France clear goods through customs on French territory;

imports under regime 40 already allow for optimized VAT management via the reverse charge mechanism, without paying VAT at customs.

Consequently, as of January 1, 2026, non-European companies, particularly British companies, will no longer have any practical reason to use the 42 regime, especially since the regime is restrictive in that goods must be re-shipped from France to another EU country within a reasonable period of time.

They will in any case be required to register for VAT in France, which makes it simpler, more efficient, and more consistent to directly release the goods for consumption on French territory.

MAVAT can take care of your VAT registration in France so that you can continue your activities in the European Union, and can also advise you on strategic choices to avoid significant cash outflows.

1 2 South Africa, Antigua and Barbuda, Armenia, Aruba, Australia, Azerbaijan, Bosnia and Herzegovina, Cape Verde, Curaçao, Dominica, Ecuador, Georgia, Ghana, Grenada, Greenland, Cook Islands, Faroe Islands, India, Iceland, Jamaica, Japan, Kenya, Kuwait, North Macedonia, Mauritius, Mexico, Moldova, Nauru, Niue, Norway, New Zealand, Pakistan, French Polynesia, Republic of Korea, United Kingdom, Saint Barthélemy, Saint Martin, Sint Maarten, Tunisia, Turkey, Ukraine, Vanuatu